PORTFOLIO

LOANS

Outside-of-the-box loans are known as portfolio loans. The name comes from the fact that, in this case, rather than being sold off to Fannie and Freddie or backed by FHA/VA, the debt is kept as part of the investor’s portfolio.

The biggest benefit to a portfolio loan as the borrower is that, the investor can set their own rules. Essentially, a portfolio loan may allow you to get financing that would be otherwise unavailable to you.

Programs listed below subject to change without notice.

Click here to go to our No Income Loan Inquiry Form:

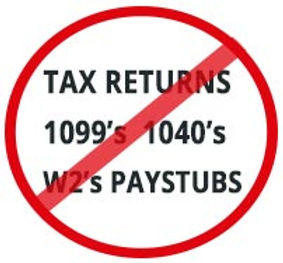

NO INCOME PRIMARY OR SECOND HOME PURCHASE OR REFINANCE

Market leading, proprietary program that provides funding access to Borrowers who would otherwise not qualify under GSE or Jumbo guidelines. Think outside the box: self employed borrowers, clients on fixed income, or small business owners.

-

No Income / Employment: No work history required

-

Loan to Value depends on credit score: as high as 80% (Purchase/Rate & Term) & 75% (Cash out refi)

-

FICO as low as 640

-

Reserves: 12 months – 24 months depending on FICO

-

Refinance: Cash out can be used for reserve requirements

-

Occupancy: Owner Occupied & Second Homes

-

Loan Amount: Up to $3M

-

Assets sourced and seasoned for 30-days.

-

Gift funds ok for down payment or closing costs only (not reserves)

-

Bankruptcy Seasoning: One day from discharge allowed

-

Foreclosure/Short Sale DIL seasoning: 12 months

-

No mortgage lates within 12 months

-

Fixed, ARM, and Interest Only program options (IO not available in Texas)

-

Eligible property types: SFR, PUD, Townhome, condo, 2-4 unit, Modular, Rural & Log Homes. Manufactured not eligible.

-

Closed in-house

-

No prepay penalty

-

Program guidelines subject to change without notice

NO INCOME | NO DOC

INVESTOR HOME LOANS

-

No Income / Employment: No work history required

-

FICO as low as 680

-

Reserves: 6 months – 12 months depending on FICO

-

Refinance: Cash out can be used for reserve requirements

-

Occupancy: Investment

-

#of properties: up to 20 financed

-

Loan Amount: Up to $3.5M

-

Assets sourced and seasoned for 30-days. No gift funds.

-

Bankruptcy Seasoning: 24 months

-

Foreclosure/Short Sale DIL seasoning: 36 months

-

No mortgage lates within 12 months

-

Fixed, ARM, and Interest Only program options (IO not available in Texas)

-

Eligible property types: SFR, PUD, Townhome, condo, non-warrantable condos max 65% LTV, 2-4 unit. Manufactured and log homes not eligible.

-

Closed in house

-

1-3 year prepay options

-

Program guidelines subject to change without notice

Prime Plus Jumbo Program

-

FICO 660+

-

Loan amounts to $4M (Based on FICO & Reserves)

-

Enhanced Debt to Income ratios

-

90% Loan to Value -- Purchase / Rate & Term

-

80% Loan to Value - Cash Out

-

No Prepayment Penalty

-

Cash Out can be used for reserve requirements

-

Closed in-house

-

Program guidelines subject to change without notice

Alt-Doc Program

-

Options available: 12 Mos. Bank Statements / 1 yr 1099 / 1 yr W2 / 1 yr Tax Return / Asset Qualifier

-

FICO as low as 660

-

Down payment based on score (as little as 15% down with 720+ score)

-

Loan Amount to $4M (Based on FICO & Reserves)

-

Enhanced Debt to Income ratios

-

No Prepayment Penalty

-

Primary & Second Homes

-

Cash Out can be used for reserve requirements

-

Closed quickly in-house

-

Program guidelines subject to change without notice

BRIDGE LOAN

-

1 Year and 3 Year Terms available

-

Interest Only Payment with Balloon at the end of the term

-

Available as 1st or 2nd Lien

-

Second Home and Investment Properties

-

Max LTV/CLTV: 80% Primary & Second Home -- 75% Investment

-

Min. Fico: 660

-

Reserves: 6 to 12 mos.

-

Max Loan Amount: 1st lien: $2.5 M | 2nd Lien: $500k

-

Closed in-house

-

Program guidelines subject to change without notice